Dormant Bitcoin Giant Stirs, Unloads 12,000 BTC In Surprise Move

A large, dormant Bitcoin wallet moved a massive amount of coins to an exchange on Thursday, rattling traders and reigniting debate about where big holders stand.

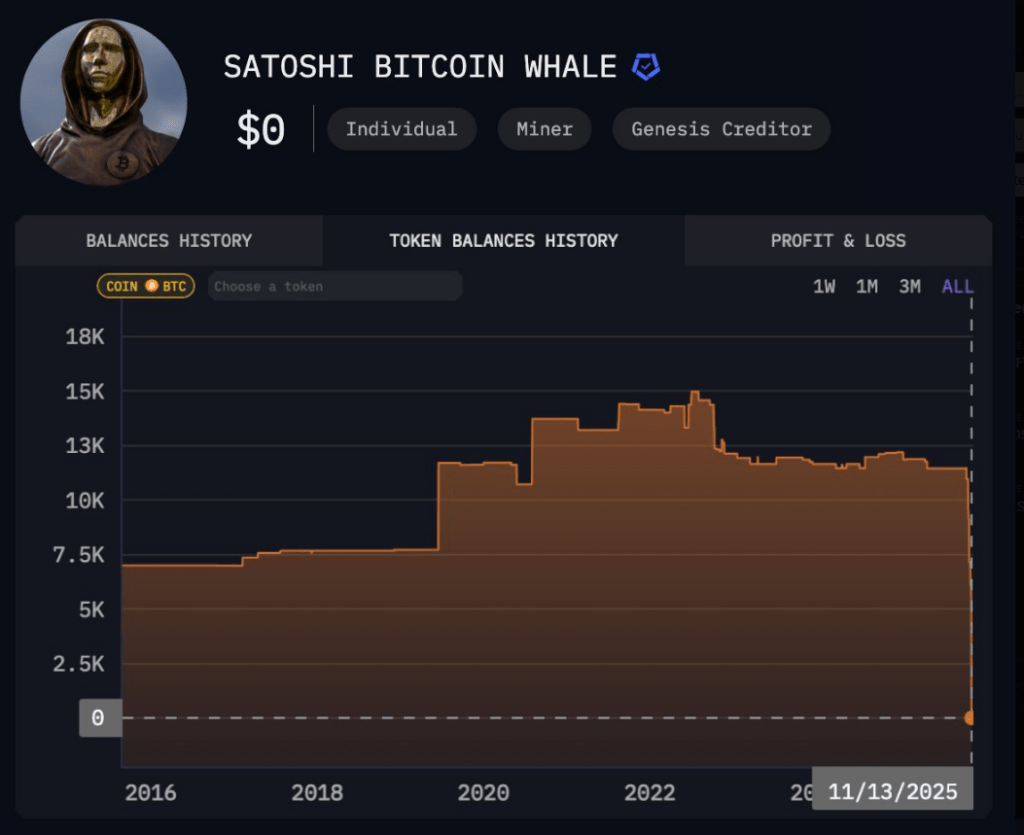

According to on-chain data, a Satoshi-era wallet that had not moved funds for 13 years transferred roughly 12,000 BTC — about $1.4 billion at current prices — in a set of transactions that landed on an exchange ledger.

Whale Moves Stir Markets

Reports have disclosed that the transfers came as Bitcoin hovered near a key price band. The coin fell about 2% after the activity, a quick reaction as traders guessed the funds might be put up for sale.

BREAKING

SATOSHI ERA WHALE JUST SOLD 12,000 $BTC AFTER 13 YEARS OF HODLING.

HE MADE A MIND BLOWING $1.4 BILLION – ONE OF THE MOST PROFITABLE ON-CHAIN SALES EVER.

MASSIVE CRYPTO SELL-OFF INCOMING?? pic.twitter.com/NvCo9mamzT

— 0xNobler (@CryptoNobler) November 13, 2025

Some market watchers warned that if larger sell orders hit exchanges, positions using borrowed money could be forced to close, which would make price moves sharper.

Others said the market’s mood was more nervous than panicked; large transfers often spark anxiety even when no immediate sale follows.

Technical Pressure Around Resistance

Prominent analyst Ted commented that Bitcoin is facing stiff resistance around $104,000–$105,000. According to his view, holding above $105,000 could encourage renewed buying and push prices toward $107,000.

If that fails, he warned that the next clear support sits near $100,000. Traders will watch order books and exchange flows closely in coming sessions to see whether the transferred coins are converted to fiat or simply shifted between wallets.

Long-Term Holders Take Profits

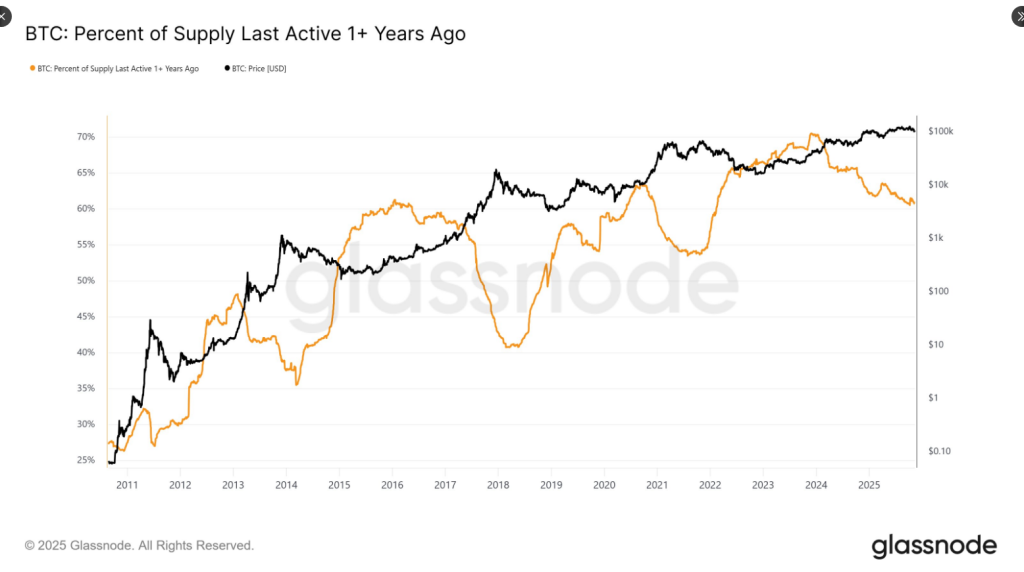

Based on reports from Chris Kuiper, CFA, the broader selling pressure appears driven more by long-term holders than by panicked sellers.

Kuiper pointed to the share of Bitcoin that has remained inactive for one year or longer. That metric usually climbs in slow markets and drops sharply during fast rallies.

This time, the decline has been gradual. The pattern suggests steady profit-taking over time rather than a sudden exodus.

“Who is selling?”

Is the number one question I’ve been getting regarding #bitcoin‘s continued price pressure against a backdrop of visible buying (by ETPs, corporations etc.)

I’m not unique in suggesting it’s the long-term holders (or HODLers).

But one data point that gives… pic.twitter.com/9PVoolrtwm

— Chris Kuiper, CFA (@ChrisJKuiper) November 12, 2025

Market observers say gradual sales fit a maturing market where older holders lock in gains without trying to time a perfect top.

Where past cycles saw abrupt moves from large dormant wallets, the current trend looks more measured. That does not rule out short-term volatility, but it changes how traders interpret big transfers.

For now, the market’s next moves will likely be set by a mix of on-chain flows and how price behaves around the $104,000–$105,000 area.

Short-term traders will react to exchange data. Long-term investors may watch the inactive-supply metric and adjust plans more slowly.

The transfer of 12,000 BTC is a big piece of information. How traders act on it will determine whether this becomes a headline event or just another moment in Bitcoin’s long rise.

Featured image from Unsplash, chart from TradingView